JSMedia – There are a number of mortgage options available to teachers and other members of the teaching profession. The Connecticut Housing Finance Authority, which offers special discounts for teachers and other state-certified employees, provides free pre-approvals to eligible applicants. In addition, the Mississippi Employer-Assisted Housing Teacher Program offers closing-cost assistance loans of up to $6,000 to qualified teachers in underserved areas. These loans automatically convert into a grant after three years of teaching.

The FHA home loan is a great option for teachers, as it is specifically designed to help low-income earners get the lowest down payment possible. Because of the low down payment requirement, most teachers are able to qualify for these home loans. In addition, the eligibility criteria are less strict than conventional mortgages, so teachers with bad credit can still qualify for this type of loan. In addition, FHA home loans offer hope to those with bad credit and lower down payments.

The FHA home loan program is a special mortgage option for educators with low credit scores. These loans require smaller down payments than conventional mortgages, and teachers who have poor credit are eligible to take advantage of this option. Typically, borrowers pay three to ten percent of the total home loan as a down payment. The eligibility criteria are not as stringent as those for conventional home loans, and teachers can qualify for FHA mortgages.

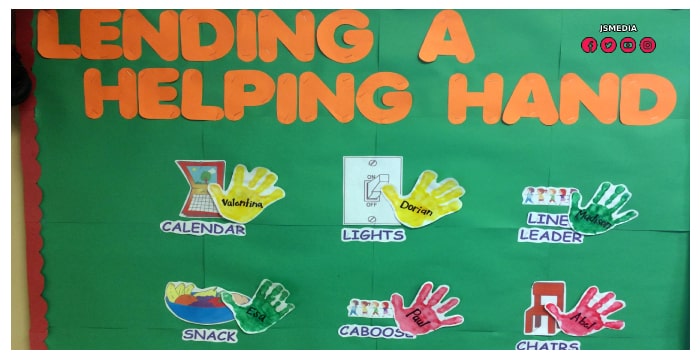

Teachers Get a Helping Hand From Mortgage Lenders

For many people, the cost of mortgages is a major expense. The monthly payment for this type of loan is significantly higher than the monthly mortgage payments for other types of loans. However, it is important to remember that a teacher’s salary does not have to be low. Using a lower down payment is the best option if you need to buy a home quickly. If you are worried about paying high upfront costs and closing costs, a special type of mortgage for teachers may be more affordable.

While teachers are often on a tight budget, they can still get a helping hand from mortgage lenders. Most lenders offer special deals for teachers and other members of the education sector. Some mortgage programs will also cover the costs of the down payment. But it’s important to be wary of any home loan offer that looks too good to be true. In addition, the government-run down payment assistance programs for educators are a reliable source of information.

Mortgage loans for teachers can be obtained from lenders offering special mortgages to teachers. If you’re a veteran, you may qualify for a VA loan. The American Federation of Teachers is another great source of information. You can also search for teacher-specific grants on the Internet. For more information on teacher-only loans, visit the website below. You can also contact the American Federation of Teachers’ local branch of the teaching profession.

Educators can get help through mortgage programs. The Good Neighbor Next Door program, for instance, provides down payment assistance to teachers. Unlike most down payment assistance programs, this program can be used to finance down payments and closing costs. The program is only available for teachers, but it’s still worth looking into. When deciding on a mortgage, keep the total costs in mind. There are several factors that will determine the final cost of the mortgage. A good deal is the best combination of fees and expenses.

New graduates can expect to earn a starting salary of $54,944 a year. This means that they can expect to earn a lot less than this. A teacher’s salary is likely to be less than $50,000. But with a mortgage, the lender will help them get started with the process of saving for a down payment. While a teacher’s income is low, they can use the money to buy a home.

Although a starting salary of $50,944 can be a great opportunity for an educator to purchase a home, they will most likely earn significantly less than this amount. With student loan debt and a poor credit history, the job can be challenging to afford a home, particularly with high interest rates. In such a situation, mortgage lenders are happy to give a helping hand to teachers. The HUD Teacher Next Door program connects educators with mortgage loans and down payment assistance.