JSMedia – Before applying for a mortgage loan, it is essential to check Virginia FHA mortgage Loan Lenders Bank’s list. This list is published by the Federal Housing Finance Agency. If you are in the state of VA, you can also check the state’s list of 203k lenders. Those with less than perfect credit may have trouble getting approved. To find the best lender in Virginia, compare several lenders’ offers.

The Navy Federal Credit Union is the most convenient mortgage lender for military members. Since it services all its mortgages in-house, it requires less points than traditional lenders. It also offers a rate loan match program. This means that, if you find a better rate, they will match it and discount your closing costs by $1,000. If you do not qualify for the lowest rate, you can use this program to find a lender in Virginia with lower interest rates and monthly payments.

The FHA mortgage loan is an ideal option for borrowers with poor credit and limited down payment amounts. Although these loans have higher upfront costs than other types of loans, the lower monthly payments and mortgage insurance premiums make them the best choice for those with a lower credit score. If you have a good credit score and are willing to pay the extra money, it is possible to get approved for a mortgage with a lower DTI.

Virginia FHA Mortgage Loan Lenders Banks List, A Buyer’s Guide

The first step in the application process is to find the best lender. Fortunately, the list also includes lenders in the region where you are looking. Simply enter your basic financial information into an online rate comparison tool and wait for it to call you with the best offers. Once you’ve found the right lender, complete the application. You’ll soon be able to close a mortgage loan. You’ll be on your way to owning a home!

To apply for a Virginia FHA mortgage loan, you must give permission for the lender to check your credit scores. You must also give the lender contact information and two years of employment history. The VA does not require down payment, private mortgage insurance, and no income requirements. You’ll need to submit a VA funding fee when applying for a VA mortgage loan. This is another important factor in finding a Virginia FHA mortgage loan.

To qualify for a Virginia FHA mortgage loan, you must be employed and have a steady income. You must also have a stable job and be at least 25 years old. If you don’t have a job in the state, you must wait a few more years to apply. If you have good credit, you should have no problem obtaining a mortgage with a VA mortgage.

If you’re looking to apply for a Virginia FHA mortgage loan, you should have a steady income. This is not the case with VA loans. The lenders need to know you’ve been employed for at least two years to qualify. However, you must have a steady job for at least a year in order to qualify for an FHA mortgage. This is necessary to show the lender that you have a stable income and can afford the monthly payments.

Besides VA mortgage loan, you can also get an FHA loan in other states. You can use a VA VAVA-approved lender to apply for a VA FHA mortgage loan. In Virginia, you can also find a list of VAVA-approved lenders. The FHA’s website offers a list of Virginia VA-approved lenders. This list is the perfect way to start a new life with a mortgage!

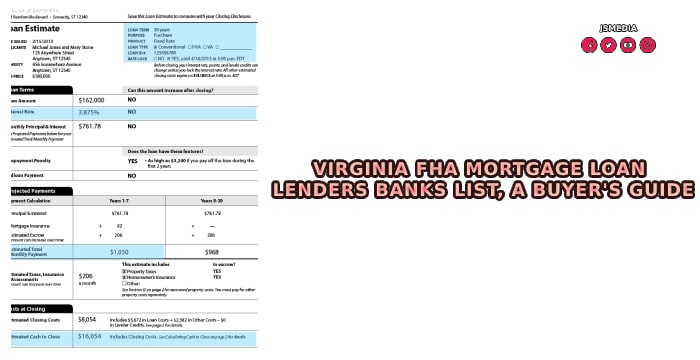

Before applying for an FHA mortgage, you should make sure that you’ve met the eligibility requirements. The maximum amount you can borrow is $822,375 for 2021. Some counties have even lower limits than this. Moreover, the maximum value of an FHA mortgage varies by county. The amount you can borrow depends on your income and the type of property you’re purchasing. It is important to remember that you’re not restricted to buying a house in your county.