JSMedia – Before releasing funds for a new build property, housebuilders and sellers must complete the Disclosure to Mortgage Lenders of Incentive Form (DEI). This document explains the financial information that a mortgage lender needs to evaluate the value of the property. This law came into effect in 2008, and is a great step towards reducing mortgage fraud. A DEI form must be filled out for every new build property, and is vital to the approval process.

A DIF must be filled out by the seller before submitting a mortgage application. It should include all relevant details, including the tenure, method of construction, and new homes warranty. The solicitor should check and verify the incentives with the buyer before submitting the application. A DIF is important to ensure that a buyer receives the full benefits of any incentives that may be offered. The DIF must be filled out properly, and any queries or discrepancies should be communicated early to avoid delays.

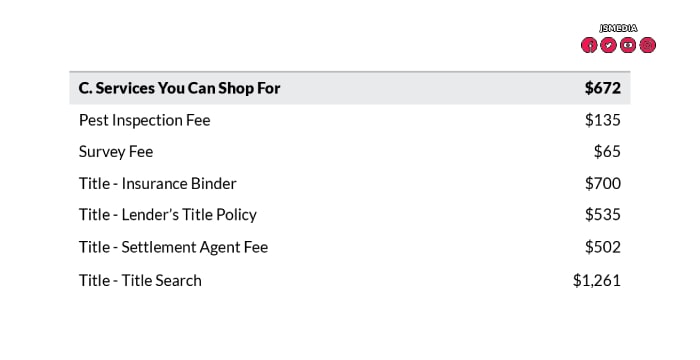

Before signing any paperwork, make sure to understand all fees and incentives that are being offered to you. Many mortgages have prepayment penalties that you must be aware of. If you have a high-end loan, be aware of any prepayment penalties that may be in place. A good mortgage lender will make these details clear and transparent to you before you sign anything. If you’re unsure, it is always better to consult with your lawyer or a financial advisor before signing any documents.

The Disclosure to Mortgage Lenders of Incentive For Buyers Guide

Incentives are a good way to encourage people to buy a new property. Incentives can include money for a deposit, stamp duty, or goods. The main focus of purchase incentives is on new build plots and the target market is first-time buyers. Unfortunately, mortgage lenders are sceptical of purchase incentives because they feel that these incentives may distort the true value of a property.

While disclosure to mortgage lenders of incentives for buyers is often mandatory, it’s still not mandatory. It is the responsibility of the purchaser to inform the lender of any such incentive. If a lender finds that a purchase incentive is not disclosed to a mortgage lender, they are likely to reject the loan application. As long as the incentives are transparent and the property is properly assessed, lenders will give you the necessary funds to complete your loan.

It is vital to fully disclose all incentives to the mortgage lender. These incentives can be valuable to buyers, but they are a form of incentivisation. If a property owner is offering an incentive, they must provide full disclosure to the lender. By giving incentives to buyers, it helps them to increase their chances of being approved for a mortgage. If a buyer is offered a property with a lower price, they may decide to cancel the offer and go elsewhere.

The disclosure of incentives to buyers should be done with the buyer’s best interest in mind. However, if a buyer is given an incentive that can lead to a higher mortgage interest rate, the seller should disclose it to the lender, as it may be a form of compulsion for the buyer to purchase the home. If a buyer’s down payment is low, a homebuyer should seek out a lender who can give them a lower interest rate.

A DIF is an important component of the mortgage loan process. It helps lenders assess the value of a home by allowing the buyer to shop around and compare offers. A DIF will also help homebuyers avoid paying hidden fees. The lender will also have the opportunity to disclose the terms of their loans. If the buyer is a first-time homeowner, they should be careful to avoid buying a home that is too costly.

Incentives for buyers are a great way to reduce the price of a home. Often, a buyer may be eligible for an incentive when they use a mortgage-lender’s preferred lender. The lender will pay the lender more attention to the DIF if a buyer uses a preferred lender. A DIF will also allow the homebuilder to advertise an incentive for buyers.