JSMedia – Consumers should always be aware of potential predatory lending practices and look for ways to avoid them. While dozens of laws are in place to protect consumers, not all are enforced. There are many reasons why retail lenders may not be able to comply with them. These lenders may use unethical means to entice people to make large loans. This is a huge risk to the consumer because they may not provide the required information or they might change loan terms.

You should shop around for a better mortgage rate. Comparison-shopping for a loan will allow you to save money in the long run. You can shop around to find the lowest interest rate, payment, and fees from several different lenders. Also, make sure you compare customer service and communication. By comparing rates and terms, you can be sure to find the right one for you. Choosing a lender based on these factors is important to ensure that you are receiving the best possible service.

While it may feel daunting to shop around, educating yourself about the process will help you approach lenders confidently. After you’ve found the best mortgage rate and terms, you can then shop around for mortgage lenders. Once you’ve found a few, you should have confidence in approaching them with your application. You should have all your documentation organized. When you’re shopping around, remember that you should be up front about your challenges.

How to Ensure That Retail Mortgage Lenders Are Not Taking Advantage of You

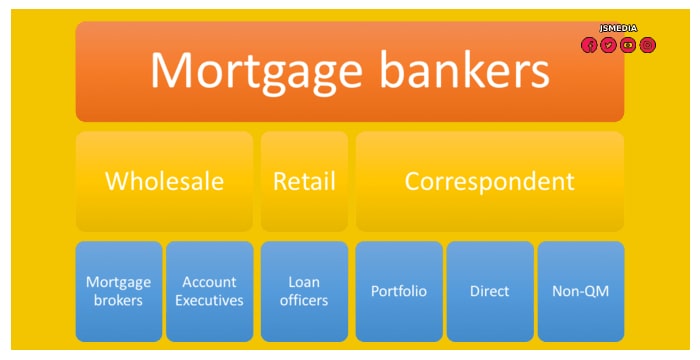

A good way to find the best mortgage rate is to shop around. There are several online wholesale lenders. These lenders may not offer as good of customer service as traditional retail lenders. You can also use a mortgage broker to do the research. You should be careful to compare the mortgage rates and fees of different banks to ensure that you’re getting the best rate. It’s better to shop around and see which mortgage rates are the most affordable for you.

Before choosing a retail mortgage lender, make sure you shop around. You should ask questions about the rates, loan terms, and fees, as well as your credit. You should check your finances and your credit score, so you can avoid making a bad decision. In this way, you’ll find the best mortgage for you. If you’re unsure of which mortgage lender to choose, talk to a financial advisor.

It is easy to find the best mortgage for you if you’re willing to work with a mortgage broker. A mortgage broker will shop for the best rate for you. In a retail mortgage transaction, you’ll be responsible for ensuring that the lender’s terms are favorable for you. If you are in a financial crisis, you can contact a licensed mortgage broker who can help you.

A private mortgage is less regulated than a retail mortgage. The only difference between a private and a retail mortgage is the time spent on paperwork and a loan officer’s involvement. When you have a private mortgage, you’ll deal directly with the lender. However, a broker isn’t the best choice in every case. You will need to interact with a loan officer to complete the loan process.

In some cases, lenders offer credits to reduce the cash needed for closing. These offers may increase the interest rate, and you’ll end up paying more in interest. It is important to review all loan estimates before choosing the best mortgage for you. A third-party cost is the lender’s title insurance, appraisal, transfer taxes, and administrative costs. It is important to know all of the costs associated with a mortgage, and compare them between lenders before deciding which one is the best one for you.

If you’re looking for a mortgage, you can look to the internet to find the best deal. You can also find wholesale lenders online. If you can’t find a direct lender, you should contact a broker. Generally, a broker can give you a better rate than a retail lender. When you are working with a bank, the mortgage will be more expensive than if you are shopping for a wholesale lender.