JSMedia – When you are looking for a mortgage lender, you’ll want to consider a number of factors. Rates and terms are one of them, but there are other factors as well. You’ll want to choose a wholesale lender that has a variety of products to offer borrowers. Most brokers don’t charge their clients anything to use their services, so you can save money by avoiding the extra fee. There are a few different factors you should consider when choosing a lender.

When selecting a wholesale lender, you’ll want to make sure that they don’t rely on your personal financial situation. If your financial situation is complicated, it’s important to work with a broker. While wholesale lenders aren’t necessarily better than direct mortgage lenders, relying on a broker can make the process easier and less stressful. You can also work with a financial institution that works with your situation and can give you advice on what options are available.

If you’re using a broker, be sure to look at multiple wholesale lenders. Although a wholesale lender won’t necessarily be cheaper, it might be better for your situation. Using a mortgage broker is a good idea, and you can also do your own research and get quotes from several different banks. A mortgage broker can also help you navigate the mortgage process because they specialize in your particular needs. They can also help you find the best mortgage rate for your situation.

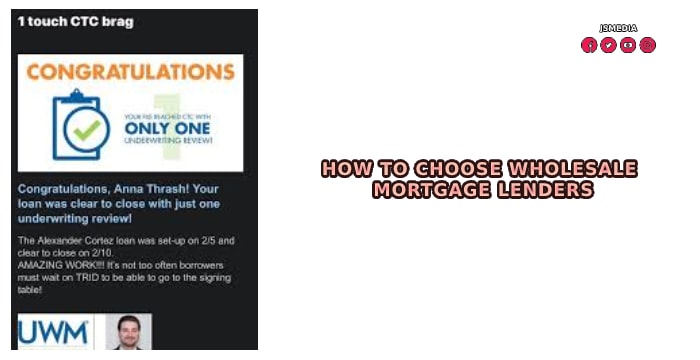

How to Choose Wholesale Mortgage Lenders

You may also need to use a broker. Most brokers have connections in the finance industry and can quickly find the best loan terms from a variety of lenders. Using a broker can save you thousands of dollars on interest rates and fees. The mortgage brokers will also help you through the application process by applying for the right loan. A real estate agent will also refer you to a wholesale lender. You can save a lot of money on mortgages if you go through a real estate agent.

It is crucial to compare wholesale mortgage lenders. A good lender will be able to offer you competitive rates and discounts. They will be able to help you find the best mortgage at the lowest interest rate. A broker can also help you with the paperwork required to obtain a mortgage. Most wholesale mortgage lenders provide valuable services for mortgage brokers. The best ones will help you save thousands of dollars on your loan. So, choose a lender based on their reputation.

The wholesale mortgage lender is the one making the loan. You do not have to deal directly with the wholesale lender, as your independent mortgage broker will handle all correspondence. The mortgage lender’s account executive will handle all the details and process the loan. The mortgage broker will get paid from the mortgage loan. So, it is important to work with a broker who will help you to choose a wholesale mortgage lender. A good bank should be able to offer you better rates and a better experience.

When choosing a wholesale mortgage lender, consider the advantages and disadvantages of each. There are pros and cons to each type of loan. The wholesale lender will be able to offer competitive rates. However, it is not recommended to use a lender that charges an excessive amount for a product. Another advantage of choosing a wholesale mortgage lender is that they can have more flexibility with terms and conditions. It is also important to choose a wholesale mortgage with lower terms.

When choosing a wholesale lender, you should look at the company’s rates. While these rates may be lower than retail rates, they may still be higher than those offered by retail lenders. Because a wholesale mortgage comes from a third-party, wholesale mortgage rates will be higher than those offered by retail lenders. In most cases, a lender’s fees will be added to the loan. But they should not charge additional fees for their services.

A wholesale mortgage lender can offer lower rates than retail rates. The difference between the two is the cost. A wholesale lender will be more expensive than a retail mortgage lender, so it is best to shop around to compare rates. Besides, the rate may not be the same as the retail rate. In addition, you’ll have to pay additional fees if you use a broker. If you are looking for a wholesale mortgage lender, make sure to check whether it has the right terms and conditions.