JSMedia – Lending activity is relatively stable, with rates remaining low and borrowers paying off their mortgages at faster rates. The number of new mortgages is relatively flat, while the number of paid-off loans is increasing. As a result, the housing market continues to support the economy. The eurozone debt crisis is also affecting the wholesale funding markets, which could put a damper on remortgaging.

The latest figures from the Council of Mortgage Lenders show that the property market is relatively subdued but stable. The council’s chief economist, Bob Pannell, said that house purchase activity will likely fall in the coming months. This is not a cause for alarm. The recent weak performance of other major economies has dampened UK prospects, and renewed stress over government finances has put the brakes on the economy.

As a result, the FPC is reviewing the recommendations for a tightening of the mortgage market. The recommendations aim to guard against a material easing of underwriting standards and a rise in household debt levels, which would aggravate the impact of the economic downturn. However, the figures for August suggest that lending to homeowners is still stable. While investor demand remains weak, owner-occupiers remain the main drivers of the housing market, with interest rates being the most significant concern.

Mortgage Lending Remains Subdued But Stable

Despite the slowdown, the overall housing market is still showing signs of life. According to the latest Fannie Mae survey, fewer mortgage lenders are enforcing stricter credit standards. The survey results also showed that a significant proportion of lenders are tightening their standards for GSE-eligible loans. The recent data on housing activity indicates that home-owners are not losing hope.

The FPC aims to simplify the macroprudential regulatory framework by introducing the affordability test. This measure will affect only a small number of borrowers, so it is unlikely to affect the housing market as a whole. It is important to note, however, that it does have an impact on the economy. Regardless of the effect of the MCOB, the mortgage market is expected to remain steady for the rest of the year.

In February, Fannie Mae’s first quarter 2016 Mortgage Lender Sentiment Survey revealed that the majority of lenders expect to loosen credit standards, which is a positive sign for the housing market. The number of lenders who expect to loosen their standards for mortgages fell dramatically from the previous quarter. And, a large number of them anticipate a greater refinancing demand for a long time.

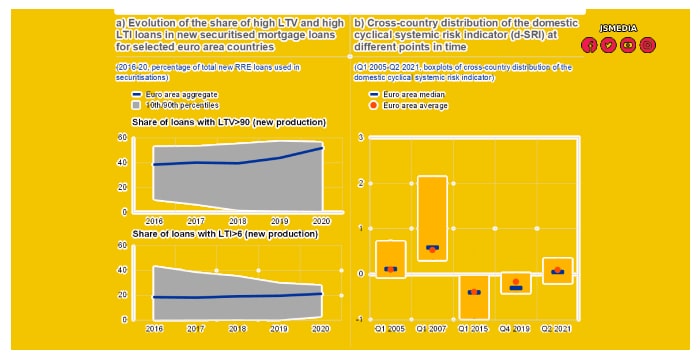

Despite the current market, the mortgage industry has seen an increase in the past few months. In July, lenders raised their standard rates for government and non-GSE-eligible loans, while a small number of lenders were cautious in the past year. In June, the index of asking prices showed a slight increase of 2.6%. The market has been stable since the summer, but still requires caution. Many of the banks are pushing high loan-to-value products.

During the first three quarters of 2021, mortgage rates have decreased. This is due to improved macroeconomic conditions, ample liquidity in the banks, and competition between lenders. Some lenders have also repriced some of their products to reflect higher risk-free rates. Although the macroeconomic outlook is still bleak, the recent decline in mortgage rates is encouraging. There is still room for further improvement, but interest rates remain low.

This decline is due to the continued improvement in the housing market. While the economy is improving, lenders are facing increased competition and the emergence of a highly indebted population. While the increase in aggregate mortgage debt may be a cause for concern, the recent strength of the housing market in the UK has not led to a deterioration of lending standards. Lenders’ expectations for profit growth in the purchase market have dropped since the last recession, but the percentage of lenders who are optimistic about the economy has risen to its highest level since the survey was conducted.

Despite this deteriorating situation, mortgage lending is still continuing at a relatively low pace. In the third quarter of 2016, lenders reported a 79 percent increase in their net profit margins for all types of mortgages. This is a significant increase for the year. But there are also risks in this market. There are a few factors that could hinder the growth of the housing market. The U.S. presidential election is a key factor in the housing market, and the results of the election are not encouraging.