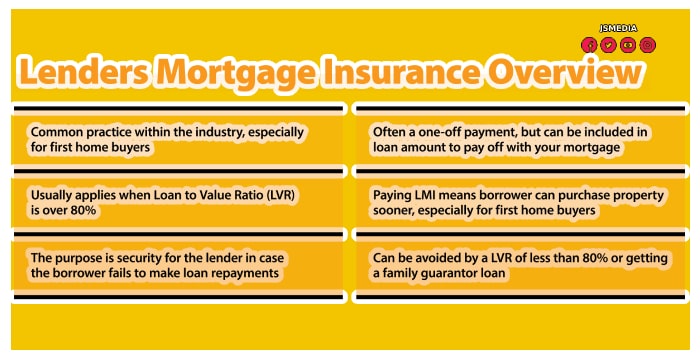

Lenders mortgage insurance is a form of property insurance that protects the lender. This type of policy covers the loan to the bank in case the borrower defaults. This type of insurance helps the borrower get a house more quickly if the price is higher than the equity in their home. Although it has its disadvantages, it has its benefits. It is a great way to avoid Lenders Mortgage Insurance (LMI) altogether.

Lenders Mortgage Insurance is a fee paid by the lender to protect them against loss. The lender is not responsible for paying the insurance, so you will have to make the repayment yourself. You may need to pay a large upfront fee, but in the long run, you will save money and avoid paying LMI. The cost of Lenders Mortgage Insurance can be substantial, but it’s a worthwhile investment.

What is Lenders Mortgage Insurance?

Lenders Mortgage Insurance is a financial protection product that covers the risk of the Bank if you default on your mortgage. It protects them against losses in the event of your death, sickness, disability or unemployment. Lenders Mortgage Insurance does not cover the full cost of your home loan. However, it is a worthwhile option to consider. With lenders mortgage insurance, you can be sure that your bank will be protected against any loss if you default.

}Lenders mortgage insurance is a form of property insurance that protects the lender. This type of policy covers the loan to the bank in case the borrower defaults. This type of insurance helps the borrower get a house more quickly if the price is higher than the equity in their home. Although it has its disadvantages, it has its benefits. It is a great way to avoid Lenders Mortgage Insurance (LMI) altogether.

Lenders Mortgage Insurance is a fee paid by the lender to protect them against loss. The lender is not responsible for paying the insurance, so you will have to make the repayment yourself. You may need to pay a large upfront fee, but in the long run, you will save money and avoid paying LMI. The cost of Lenders Mortgage Insurance can be substantial, but it’s a worthwhile investment.

Lenders Mortgage Insurance requires a one-off premium. Health Professionals Bank adds this cost to your loan. The lender pays for the premium by increasing the amount of your loan. The cost of the premium depends on the size of your deposit and the type of loan you take out. In some cases, the lender may even refund the LMI premium if you repay the loan within the first two years. You should consider all the risks of Lenders Mortgage Insurance before you make a final decision.

Lenders Mortgage Insurance is a legal requirement for all home loans. You should never opt for Lenders Mortgage Insurance unless you are sure you can afford it. Your lender will require a substantial amount of LMI before they can approve you for a loan. You should be aware that you are liable for paying the premium as it is part of your loan. This Lenders Mortgage Insurance is not a loan.

Lenders Mortgage Insurance protects the lender if you default on your loan. You will need to pay a premium each month for the coverage. You will have to pay this premium each month in order to keep your mortgage payments low. During the first few months, you will have to repay LMI monthly. But you should not worry because Lenders will pay the cost for you. This insurance is a legal requirement for lenders and you can’t opt out.

Lenders Mortgage Insurance protects the lender against losses if you default on your loan. It is required by law for a home buyer to make a 20% deposit. If you have a less than 20% deposit, Lenders Mortgage Insurance is worth considering. This insurance will protect the lender from losing their entire investment if you don’t pay your loan. In fact, LMI costs the lender a considerable amount of money.

Lenders Mortgage Insurance is a vital part of buying a home. Lenders mortgage insurance protects the lender in the event that you default on your loan and lose your home. It is a legal requirement for all home buyers in the United Kingdom. It is also important to note that Lenders Mortgage Insurance will cover the cost of your loan. Lenders Mortgage Insurance can help protect you and your lender in case of any loss.

Lenders Mortgage Insurance can protect the lender if you default on your mortgage. This policy is a one-time premium that protects the lender against loss. The cost of LMI depends on the amount of deposit you have and the value of your property. Lenders Mortgage Insurance will increase the cost of your mortgage if you don’t make your payments on time. Often, it is best to have a larger deposit than you can afford.