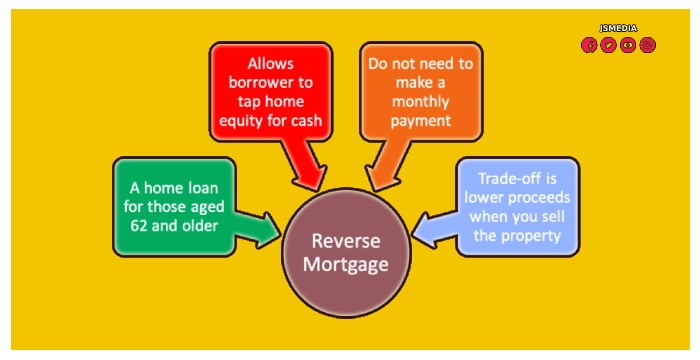

JSMedia – Reverse mortgage loans are a relatively new type of home equity loan.While they sound like home equity loans, they are quite different from them. Unlike conventional loans, reverse mortgages are made by banks, and are intended to be paid back over a number of years, usually until the borrower dies or moves out of the home. The main advantage of a reverse mortgage is that you don’t have to have a good credit score or earn a high income to qualify. You don’t have to keep up with loan payments as long as you are living in the home as a primary residence.

Reverse mortgage lending for banks is becoming a popular source of extra funds for older people, with an increasing number of people seeking assistance. The growing popularity of reverse mortgages has given the bank-owned sector a major boost. While banks are regulated more tightly than non-bank lenders, the latter are not insured by the federal government, making them less trustworthy. This means that reverse mortgage lenders can be risky, but they can also be a viable option for people who need additional funds.

Reverse mortgages are a popular option for older borrowers. These loans are often characterized by strict eligibility requirements, and a minimum of 50% equity is required. The lender wants to ensure that borrowers are not over-borrowing. In addition to that, they don’t require debt-to-income ratios, which are major criteria for qualifying for a regular mortgage. However, you must be able to prove you have the financial resources to maintain your home.

Reverse Mortgage Lending For Banks

A reverse mortgage is a great option for people who need money to take care of their retirement. Reverse mortgages can help them achieve their financial goals and provide peace of mind. Reverse mortgages are a good choice for older borrowers. There’s no income or credit requirement to qualify. As long as you have a high percentage of equity in your home, you’ll be able to get a great deal of money.

Reverse mortgages are not for everyone. Whether you’re interested in a reverse mortgage for your own needs, or are looking for an alternative way to finance your retirement, you should be able to find a lender that suits your needs. There are different types of reverse mortgages for different purposes. A single-purpose reverse mortgage is the least expensive. A home equity conversion loan is a loan you take out from your home. If you have equity in your home, it can be beneficial to remodel your house or finance healthcare costs.

Reverse mortgages are not suitable for everyone, and banks need to make sure that they protect their reputation and consumers. Reverse mortgages are a complex and complicated form of home equity loans, and lenders need to make sure they implement controls to minimize the risks and improve their reputation. In addition, there are potential conflicts of interest and abusive practices with these transactions. Reverse mortgages are not for everyone. Therefore, it’s important to find a qualified lender before applying for a home equity loan.

A reverse mortgage will benefit from a higher appraised value on the property. The lender can also avoid a loss of property tax and homeowners’ insurance. Reverse mortgages can be a valuable source of income for elderly homeowners. Reverse mortgages are also an excellent source of capital for those who need additional funds to meet their expenses. This type of loan is available to many people. The maximum loan amount for a home equity loan in January 2021 is $822,375, which is approximately 58% of the claimable value.

Reverse mortgages are risky for borrowers. Because the risk of defaulting is significant, banks need to ensure that they are aware of the risks involved before offering reverse mortgages. The risks to both the lender and the borrower are significant. Reverse mortgages should be carefully considered by potential borrowers. A prospective borrower should consider all pros and cons before choosing a lender. For example, the benefits of this type of loan are well worth the risk.