JSMedia – The Swiss franc is not a good currency for mortgage loans, so it is not advisable to take out a loan in Swiss franc. If you are planning to buy a Swiss property, you should consider taking out an offset mortgage. An offset mortgage is one where the lender agrees to convert your Swiss frank mortgage into a Polish zloty in case you default on repayments. This type of loan is available in all countries, but is typically only for up to 5 years.

The interest rate on a Swiss mortgage is higher than that of a UK mortgage. However, most lenders in Switzerland will give you a loan of up to 80% of the purchase price, but you must pay 20% of it in real money. This means that if you want to buy a property worth CHF 750,000, you need to have at least CHF 75,500 in cash. In addition, you have to take into account the fact that the monthly repayments cannot exceed 33% of your salary. Even if you pay your bills on time, your Swiss franc loan will still cost you around 6% of your combined salary.

Fortunately, Swiss lenders are now starting to offer forward-fixed-rate mortgages. These types of loans allow you to set the start date of payments, but they do require a certain amount of money up-front, which is why they are best suited for first-time buyers. Alternatively, a variable-rate mortgage is a better choice if you want to have more flexibility over your payments.

Mortgage Loans: Don’t Cry For Swiss Franc Lenders

Those in need of a mortgage may want to switch to sterling or euros after their loan has matured. Many Swiss bankers have a list of the main Swiss banks. In addition to this, Moneyland has compiled a list of Swiss mortgage deals. Be aware that there are no help-to-buy schemes, so if you don’t have a 20% deposit, you will not be able to get a Swiss mortgage.

In Switzerland, mortgages can be arranged in different currencies. You can choose to take a mortgage in euro or Swiss franc. Then, you can choose whether you want an interest-only or a fully-paid mortgage. For the latter, you will need to put a 20% deposit. There are also fixed-rate mortgages in Switzerland. With fixed-rate options, you can plan your finances more easily and comfortably.

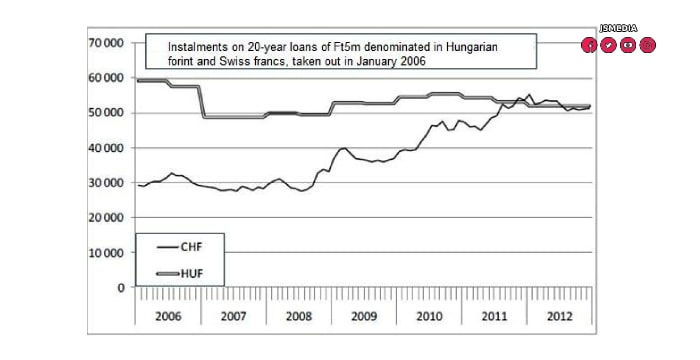

In Hungary, Swiss franc debt is 12 percent of GDP, which means that you should avoid loans in foreign currency. The central bank has announced that it is willing to replace the foreign currency loans with forint ones. In Russia, Russians have also taken out mortgages in Swiss franc, and in the last six months, the value of the ruble in Hungarian franc has doubled.

The Swiss franc is in trouble in several countries, including Hungary. The country has a large amount of Swiss franc debt, which is 12 percent of GDP. It is also facing legal battles involving Russian mortgages. As a result, the national banks in the CEE region are offering to replace these loans with forint ones, which is a sign of hope.

While the KNF ruling would level the playing field for all Swiss franc mortgage holders, it’s still worth considering the implications. Unlike Poland, the Swiss franc is a stable currency and can be used in any country, including Poland. In addition, the loan costs in Swiss francs are lower than in Polish zlotys. A few borrowers are taking the risk and are paying higher rates in the end, but it is better to be safe than sorry.

The downside of a Swiss franc loan is the currency risk. While it is true that you’ll pay more interest in Swiss francs than in Swiss francs, the tax benefits are worth it. In addition to reducing your tax bill, the interest charges on the mortgage can also be deducted from your annual income. If you find a better deal elsewhere, you can switch to that provider. It’s important to remember that switching providers may come with extra fees.