JSMedia – Lenders use the lower of two FICO scores when evaluating mortgage applicants. However, most people only have one usable score. That’s okay – if you have two decent credit scores, your lender won’t have any problems giving you a loan. But if you have three, you’ll have to work harder to get approved. Regardless, here are some things you should keep in mind.

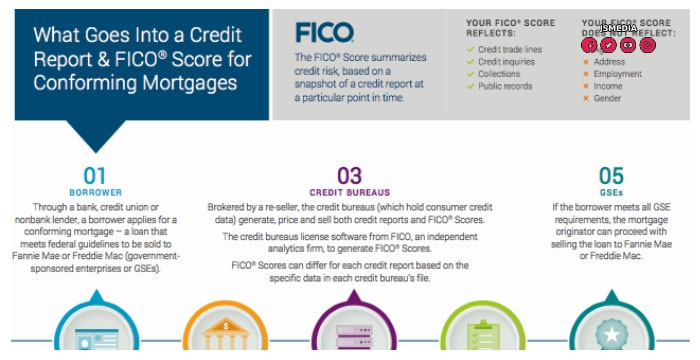

The first step in securing a mortgage loan is to check your credit report. A lender will pull your credit report to assess your eligibility to take out a mortgage. You can obtain a copy of your credit score by visiting the Better Business Bureau or your financial institution. You can also check the FICO scores of lenders in your state or province. The better your score is, the higher your interest rate will be.

The latest FICO credit score is FICO 10 Suite. This is the most current version. The older scores have less information than the newer ones. The mortgage industry uses FICO 8, while auto lenders, credit card issuers, and even mortgage lenders use different scores. The Dough has more details on the FICO score system and how it works. The Dough is here to help you choose the best lender for you.

Which FICO Scores Do Mortgage Lenders Use? The Dough’s Mortgage Guide

In general, lenders use the FICO score in calculating a mortgage loan. The older the FICO score, the higher your risk of defaulting. This is a fact that is widely known. But there are some things you can do to avoid having your score lowered. This is why it is important to know your FICO scores. The better you understand them, the lower your mortgage rate will be.

The FICO score is a score used by mortgage lenders. Although there are other FICO scores, most lenders use the same version of the FICO score. This means that the three different FICO scores are the same. In other words, if you’re looking to borrow money, you need to have a high FICO score. For instance, if your credit score is high, your lender will have a lower rate than you. The lower your FICO score, the higher your interest rate will be.

When applying for a mortgage, you’ll need to have a minimum score. The higher your FICO score, the better. This is a good way to improve your credit score. It can also help your chances of getting approved. It’s best to aim for a credit score that’s between 650 and 700. So, while the minimum amount is high, you should not expect the highest.

Most Canadian lenders use the FICO score, also known as the Beacon. While the FICO is all-purpose, the Beacon score is a proprietary model that mortgage lenders use. It is a risk-based score, which is why it’s worth looking for it. In Canada, your credit score is not a public record. If you can get your FICO report from your lender, the lender will not disclose it to you.

Most mortgage lenders in America use the FICO score to evaluate your creditworthiness. These scores range from the low 300s to approximately 850. The higher your FICO score, the lower your risk. The higher your FICO score, the more likely you’ll be approved for a loan. You should not be afraid to ask about your credit history. It’s not just your mortgage application.

If you’re looking for a mortgage, the FICO score is the number that mortgage lenders look at. These scores are not the same as yours, and they may not be the same. If your credit score is high, it is unlikely to be useful to you. If you’re unsure, you should consult your lender. It’s likely that they’ll have a different scoring system for you.