JSMedia – The Bank of England published the latest Mortgage Lenders and Administrators Statistics on Friday. The report covers the period from the Stamp Duty Holiday to 31 March. It gives an insight into how the market might be if 95% loan-to-value mortgages were back on the market. The report noted that mortgage advances with LTVs of 90% or below were down 14.7% year on year in Q1 2021. However, the value of new commitments was up 15.9%.

LTV ratios continued to fall. The share of mortgages with LTVs over 90% fell to 5.5%, while the proportion of mortgages with LTVs above 90% remained unchanged. The number of residential mortgage loans with a LTI ratio of 4.5 or higher decreased to 11.2% from 13.2% a year ago. The report states that mortgages with LTVs above 85% are now more risky than ever.

While new home mortgages fell, remortgaging grew. This is mainly due to a lower number of new mortgages. Similarly, the share of similar mortgages increased by 1.1 percentage points. This shows that people are getting into more debt than they are making. Although the rate of unemployment remains low, there is no need to panic about the housing market. Nevertheless, the numbers of borrowers whose incomes are below the median were rising steadily.

Mortgage Lenders and Administrators Statistics

The latest data for mortgage commitments indicate that new home mortgages reached PS87.7 billion in the fourth quarter of 2019. This is the highest since 2007, according to Mortgage Lenders and Administrators Statistics. The number of new loans declined in June. The share of very low-deposit mortgages dropped to its lowest level since records began. In addition, the proportion of loans with a very low deposit declined to its lowest level since the Act was passed in 1975.

Mortgage lending continues to increase in the UK. In Q1 of 2019, new mortgage commitments totalled PS87 billion, the highest since 2007. The proportion of low-deposit mortgages declined to its lowest level since the records started. Further, the Bank of England said that the share of very low-deposit mortgages declined to just 1.2%, which was the lowest since it began recording. And despite these results, new home purchases are still down.

Despite the weak housing market, the mortgage market has remained strong. The number of remortgages has reached a record high. Approximately one million people in the UK own their homes. The value of first-time home purchases was PS14.6 billion in Q3 2019. Remortgages have been falling steadily. The figures released by the Bank of England for this month are a positive sign for the housing market.

In Q3 of this year, the mortgage market was limited by the adoption of technology. There were only 2,000 remortgages, while more than 5,300 new buy-to-let home purchases were completed. The amount of remortgages in Q3 of 2020 was PS15.7 billion. This is a significant drop, but there is no reason to panic! This is just another good sign for the housing market.

The numbers are encouraging. The number of mortgages for home purchases increased by 9.1% from the same period a year earlier. The share of loans for buy-to-let properties increased to 14.1% in Q1 of 2019. The value of new home loans for house purchases remained relatively stable year-on-year, with 17.2% of loans made to first-time buyers. But the share of new mortgage commitments for remortgages falling to PS77.5 billion in the same timeframe.

The numbers for the first quarter of 2019 show that mortgages for home purchase increased by 9.1% from the previous quarter. This is the highest level since Q4 of 2007. Meanwhile, the value of new mortgage commitments was up by 15% from the same period a year ago. The value of new commitments was up to PS83.3 billion in Q1. This is significantly higher than the PS77.5 billion recorded a year ago.

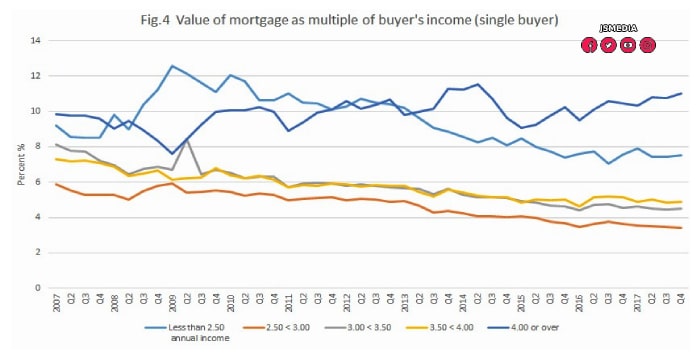

The Bank of England has delayed a base interest rate rise, but that may not be for long. The percentage of mortgages with a value of several times an individual’s income has continued to rise. The Bank of England has warned that mortgage lenders are taking more risks. The current statistics are very encouraging. But the Bank of Britain has warned that this is not the right time to relax lending practices. The recent data will only lead to greater regulation.